If you fall within a certain income bracket or are a senior citizen, you may qualify for tax filing assistance. The Volunteer Income Tax Assistance (VITA) provides free tax preparation services to people who earn $64,000 or less per year. In addition, if you are age 60 or older, you may qualify for free tax preparation services through Tax Counseling for the Elderly (TCE) how much does a cpa cost and the AARP Foundation’s Tax-Aide programs. Also, when setting an accountant’s fees, remember to calculate the time or money your company will spend on compiling documents, bookkeeping and running any software required to facilitate their job.

What are the average annual costs for a small business to retain a CPA?

Many small business owners who do their tax returns themselves mess up on reporting those complexities and end up with penalties. If you need returns done for multiple years, that may also increase the cost of working with your CPA. It’s pretty common for business owners to be behind on a few years of tax returns — especially if they’ve never worked with a CPA before. It costs more to have multiple years of returns done, but it’s worth it in many cases to avoid potential audits and penalties. If they do offer bookkeeping, you’ll likely incur the cost of these services at the higher firm-rate, contrary to paying a separate bookkeeping service to maintain your financial records.

What are the average accountant costs?

- With these accounting software platforms, you can handle your accounting activities yourself.

- Form 1120-S (for S corporations) also costs slightly less to file than Form 1120 ($913 compared to $923), and the average cost of tax preparation for LLC businesses is different compared to an S corp.

- At C.E. Thorn, CPA, PLLC, we frequently get asked about the cost of tax preparation.

- There is also free accounting software with unlimited invoicing and mileage tracking features.

Keep in mind that the CPA rates per hour can vary pretty drastically from region to region. Areas with higher costs of living, such as New York or California, may see a higher CPA cost per hour than those in the Midwest or Southeast. ”, we are going to take a closer look at the two primary payment methods used by CPAs to determine exactly how much a CPA costs. To help aspiring CPAs understand what their services are worth, we will review examples of a typical CPA cost and a CPA fee schedule to help your business pricing align with the market. CPAs who are based in larger metropolitan areas with higher costs of living typically charge higher rates than those in smaller towns or more rural areas.

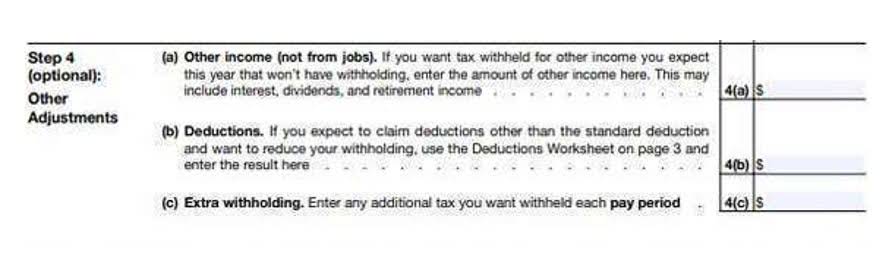

- Tax planning fees depend on the complexity and scope of the service provided, often billed hourly or as a flat fee, depending on the CPA.

- This one-time fee varies depending on your state, but it’s typically between $50 and $200, though it may be as much as $300.

- Becker is well-regarded among CPA candidates, with Becker’s students reporting a 94% pass rate on the exam.

- Though these resources can vary in cost, it’s important for CPA candidates to consider their individual needs and learning preferences when deciding on which resources to invest in.

Effective Financial Planning

One of the most frequently asked questions from CPA candidates just starting the process is about the CPA Exam cost. Several factors affect the cost of the CPA Exam, including location, whether you pass on the first try and any study materials you may use to prepare. To help you plan and prepare, learn about the costs you can expect to incur. Because accounting fees vary significantly between providers, you should shop around before committing. Ask each CPA how they bill for services https://x.com/bookstimeinc and try to get a quote for your expected needs. Remember, the hourly cost of hiring a CPA depends significantly on the type of work you need them to do.

How Much Will It Cost to Hire an Accountant to Do My Taxes?

The type Online Accounting of tax return being filed, whether it’s for an individual, business, or nonprofit organization, can also influence the cost. The tax professional helps by informing you of the information you need to gather and then prepares the tax forms needed for your situation. Sometimes, they will charge an hourly rate but sometimes it is a set fee.

Option 2. Tax preparers

Additionally, the scope and complexity of work required can significantly impact the CPA’s fees. Some CPAs may offer tiered fee structures or hourly rates, whereas others may charge a flat fee or retainer for their services. The difference in cost between an accountant and a tax preparer depends on the individual.